Federal Withholdings

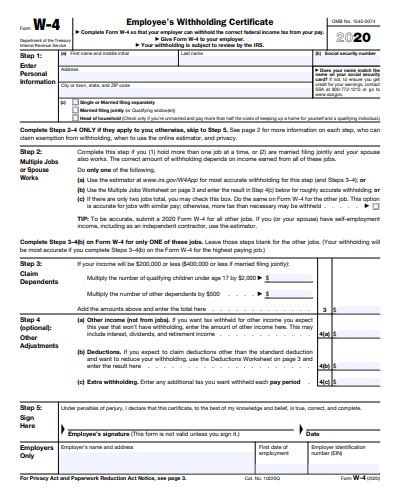

In years prior, your federal W-4 was based on the number of personal exemptions you claimed on your tax return. With personal exemption now gone, the 2020 W-4 is designed to help you determine the dollar amount your employer should withhold from each paycheck. To get the most accurate withholding amount, I highly recommend using the IRS Withholdings Estimator. Once you enter all the required information, you can generate a completed W-4 to print, sign and give your employer. If you don’t have the information needed to complete the estimator, use the personal allowance worksheet on page 4. Service members can change their withholding allowance via MyPay and civilian employees should contact HR.

Nonresident State Withholdings for Military Spouses

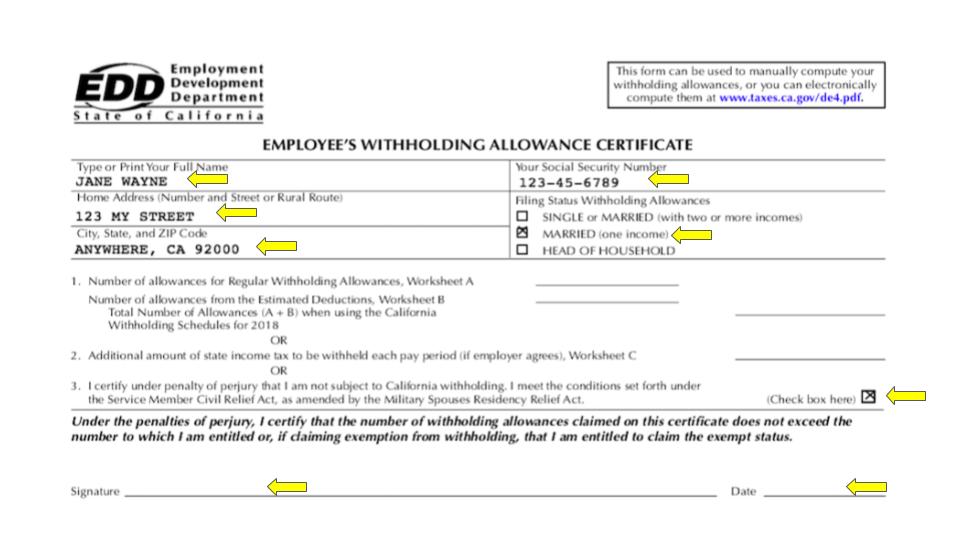

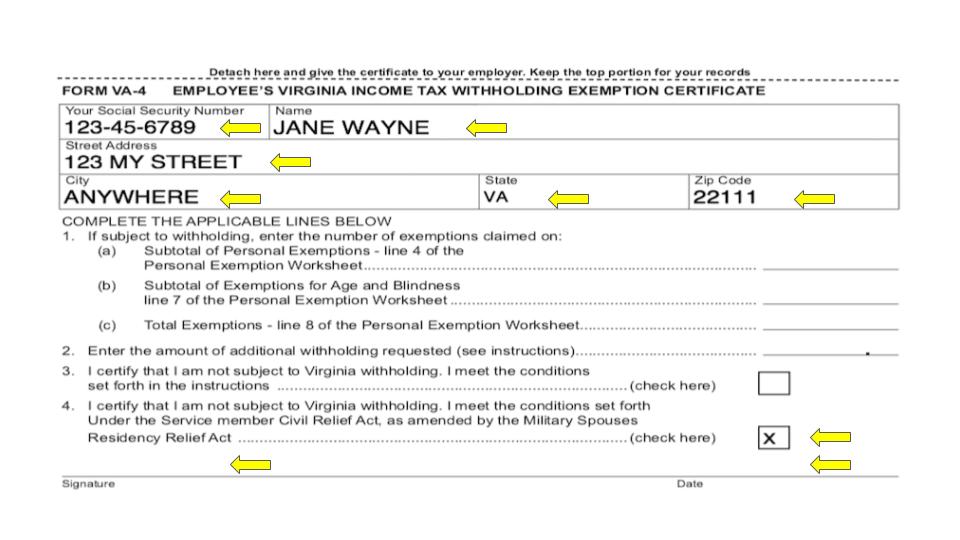

If you are a military spouse who meets the Military Spouse Residency Relief Act qualifications, you are exempt from paying state income taxes in your new duty station location. For example, if you and your active duty spouse are both residents of FL but currently live in CA or VA, your W-4 should look like one of the two below. Use your physical address on this form and submit it annually to your HR department to prevent state tax withholdings. Depending on the rules of your home state, you may be required to submit estimated taxes to avoid underpayment penalties when you file your resident state tax return.

While the federal information provided here is applicable to all, the state forms only address the most common scenario I come across – dual income with shared state of residence. If you and your spouse do not share the same state of residence, contact me for assistance.