Claim On Your 2018 Taxes

Many business owners will benefit from the new 20% Qualified Business Income (QBI) deduction created by the 2017 Tax Cuts and Jobs Act (TCJA). However, until last week, it was unclear if landlords who earned a profit from rental real estate were considered business owners and therefore able to claim this deduction.

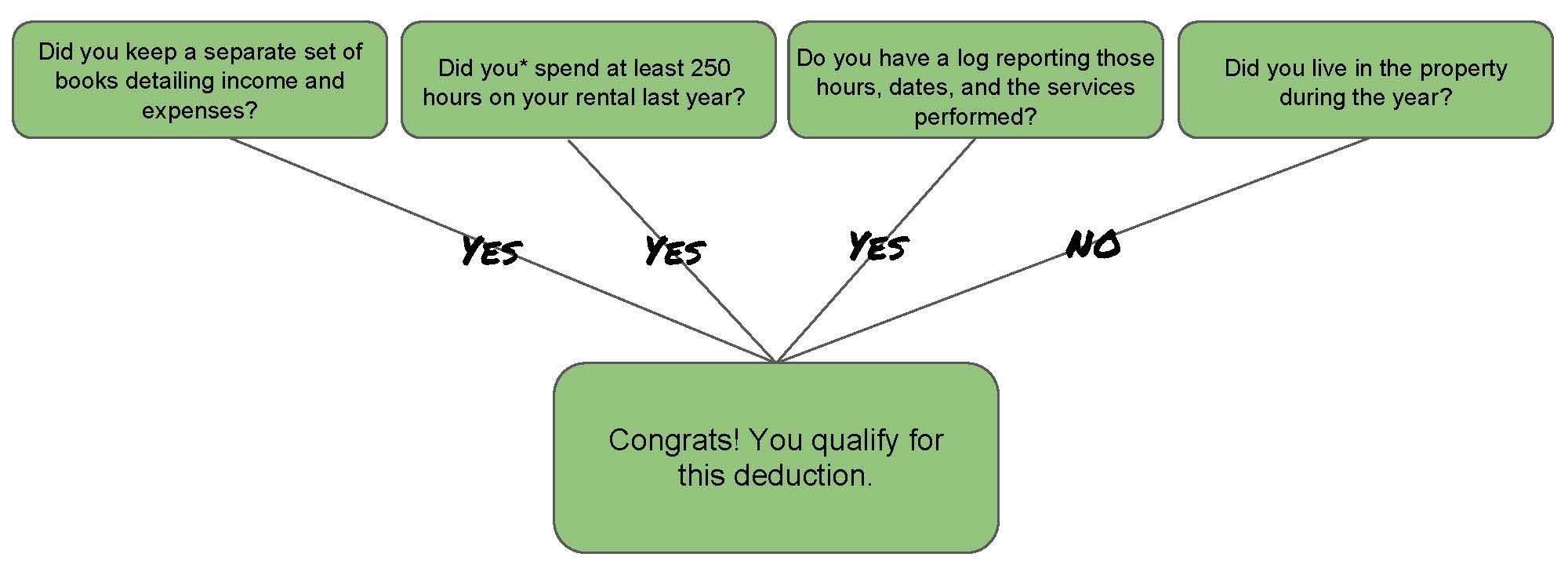

The Treasury Department and IRS released Notice 2019-07 which explains the “safe harbor” test to determine your eligibility. Using the chart below, if your answers to the questions match the ones shown, you qualify!

You must attach a statement to your tax return claiming your section 199A deduction and confirming you have satisfied all requirements.

Rental services for this deduction include:

- Advertising to rent or lease the real estate

- Negotiating and executing leases

- Verifying information contained in prospective tenant applications

- Collecting rent

- Daily operation, maintenance, and repair of the property

- Management of the real estate

- Purchasing materials

- Supervision of independent contractors, agents, or employees

Rental services for this deduction do not include:

- Financial or investment management activities

- Time spend to obtain the property

- Planning, managing, or constructing long-term capital improvements

- Time spent traveling to and from the property