by Attiyya | Sep 25, 2023 | Taxes

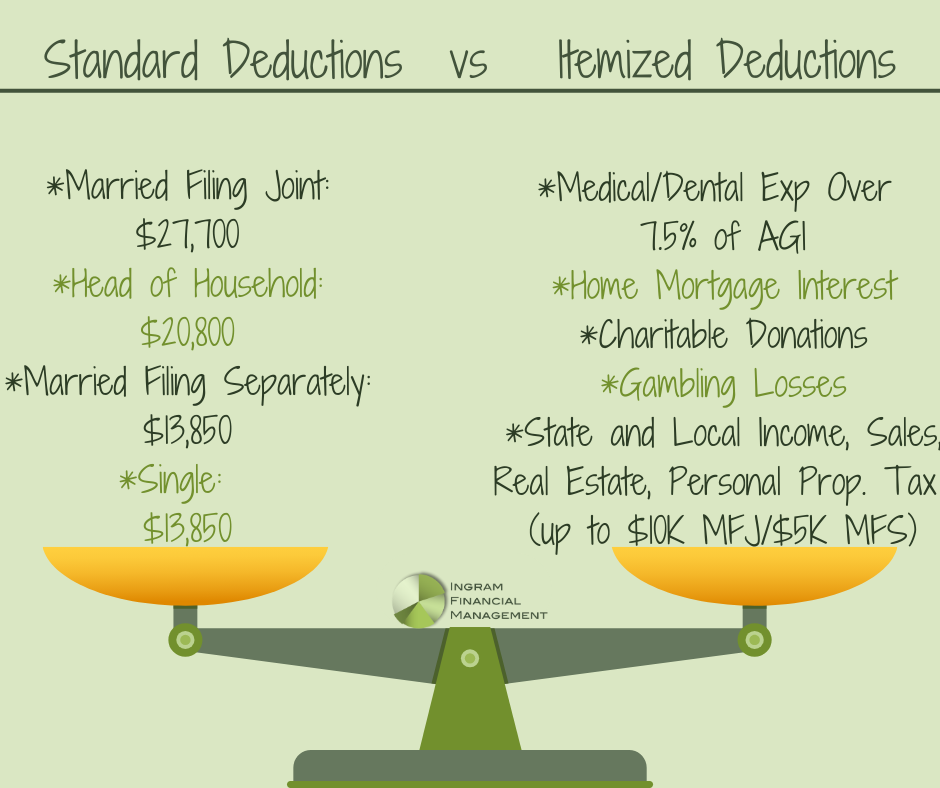

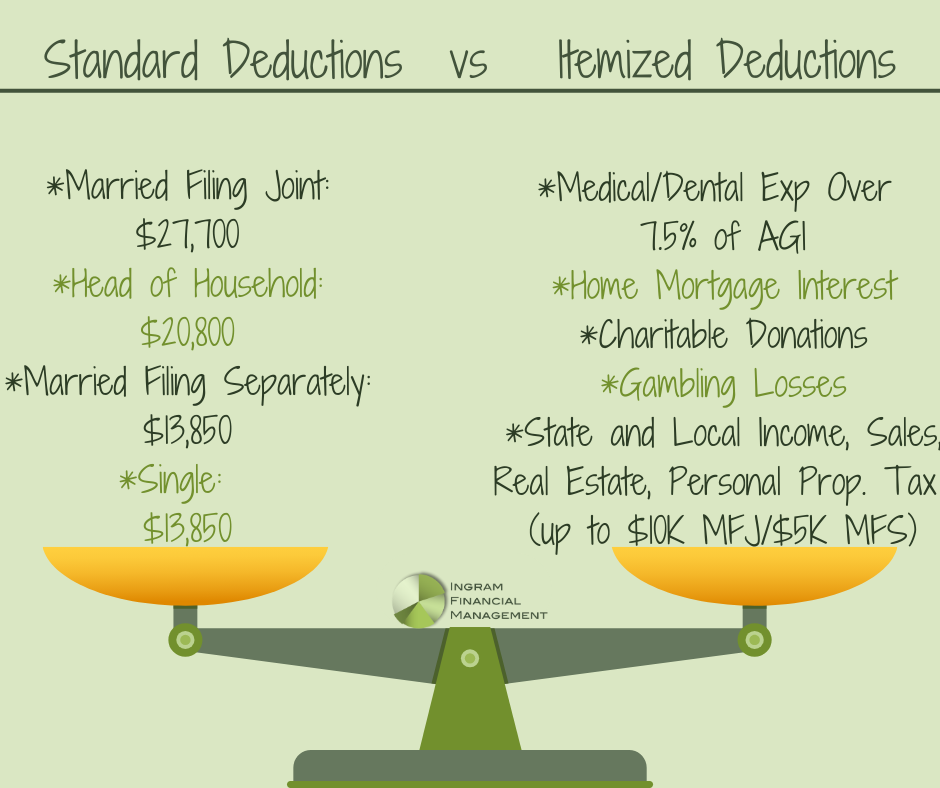

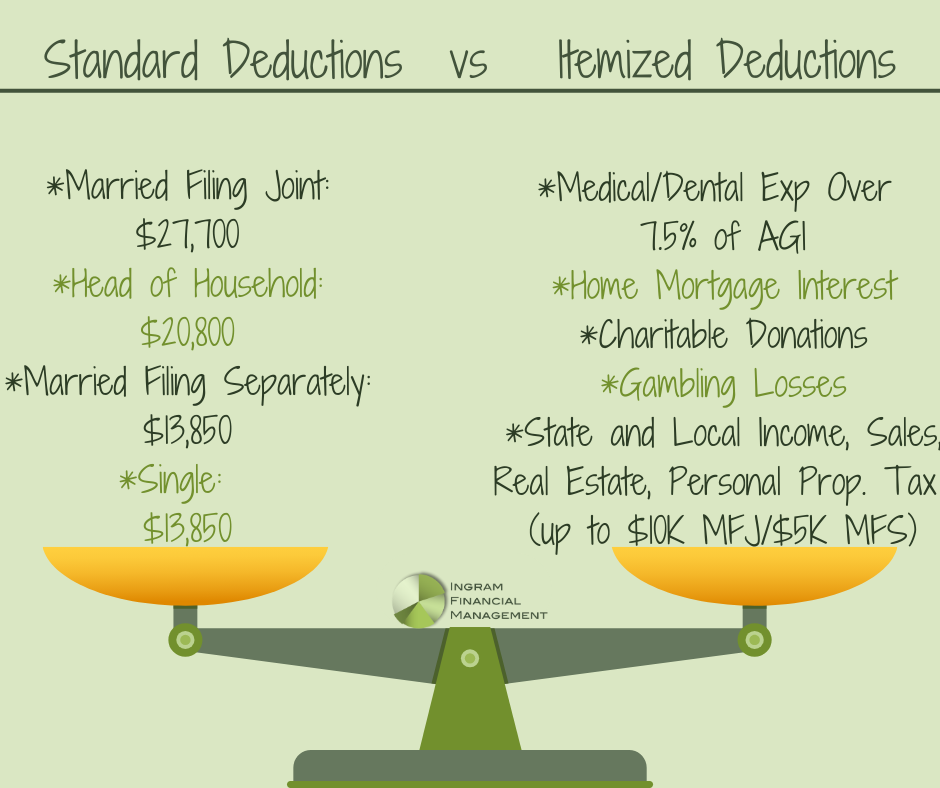

Clients often ask me why they can’t deduct their (you name it). Unless you’re paying a high-interest home mortgage or contributing generously to charity, you probably don’t have enough eligible expenses to deduct on Schedule A. Your...

by Attiyya | May 22, 2014 | Taxes

Many military families are in the final planning stage of their permanent change of station (PCS) move. As “PCS season” approaches, tax questions about what moving expenses are deductible and how to deduct them are often asked. Unlike other tax deductions, you do not...

by Attiyya | Apr 27, 2014 | Taxes

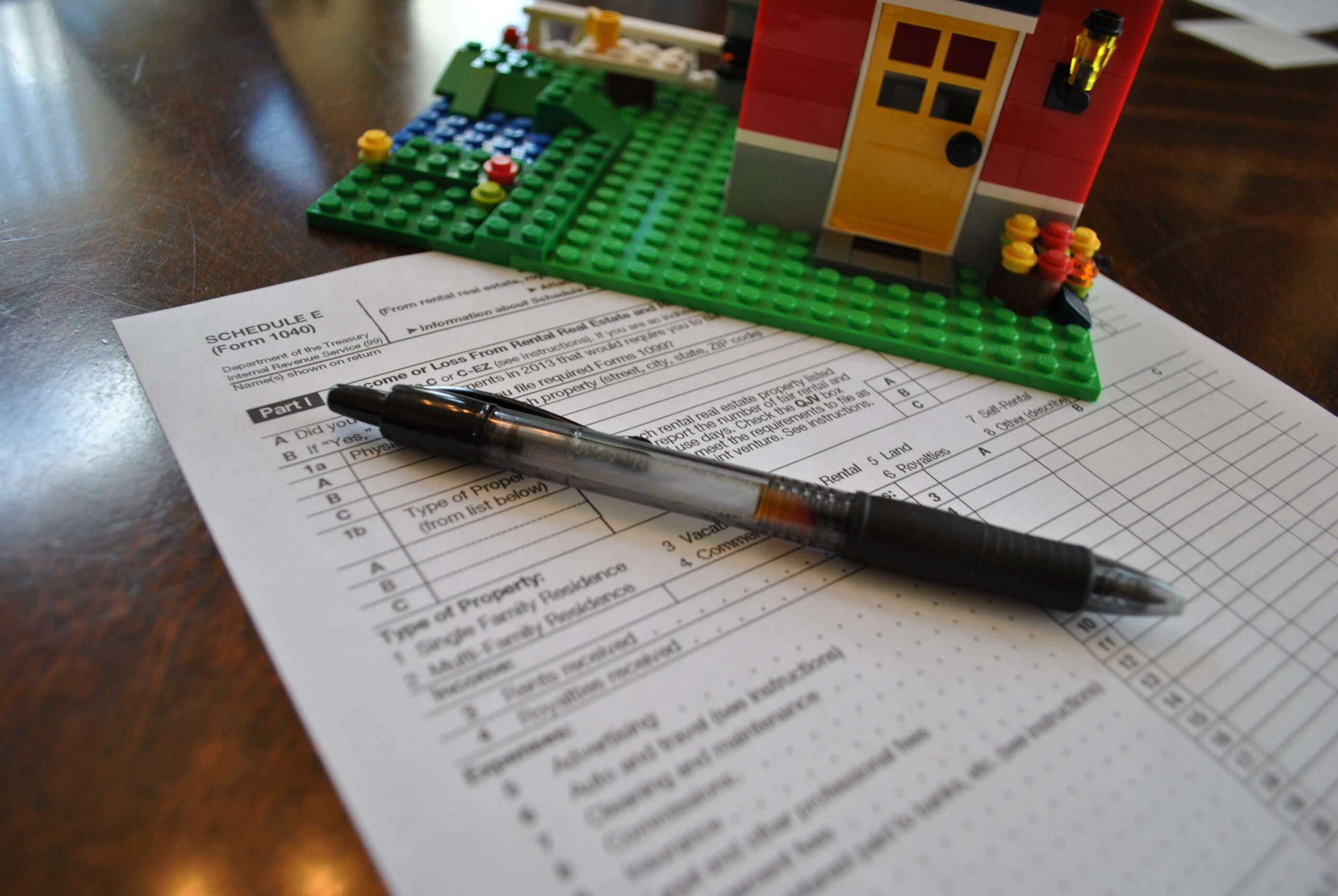

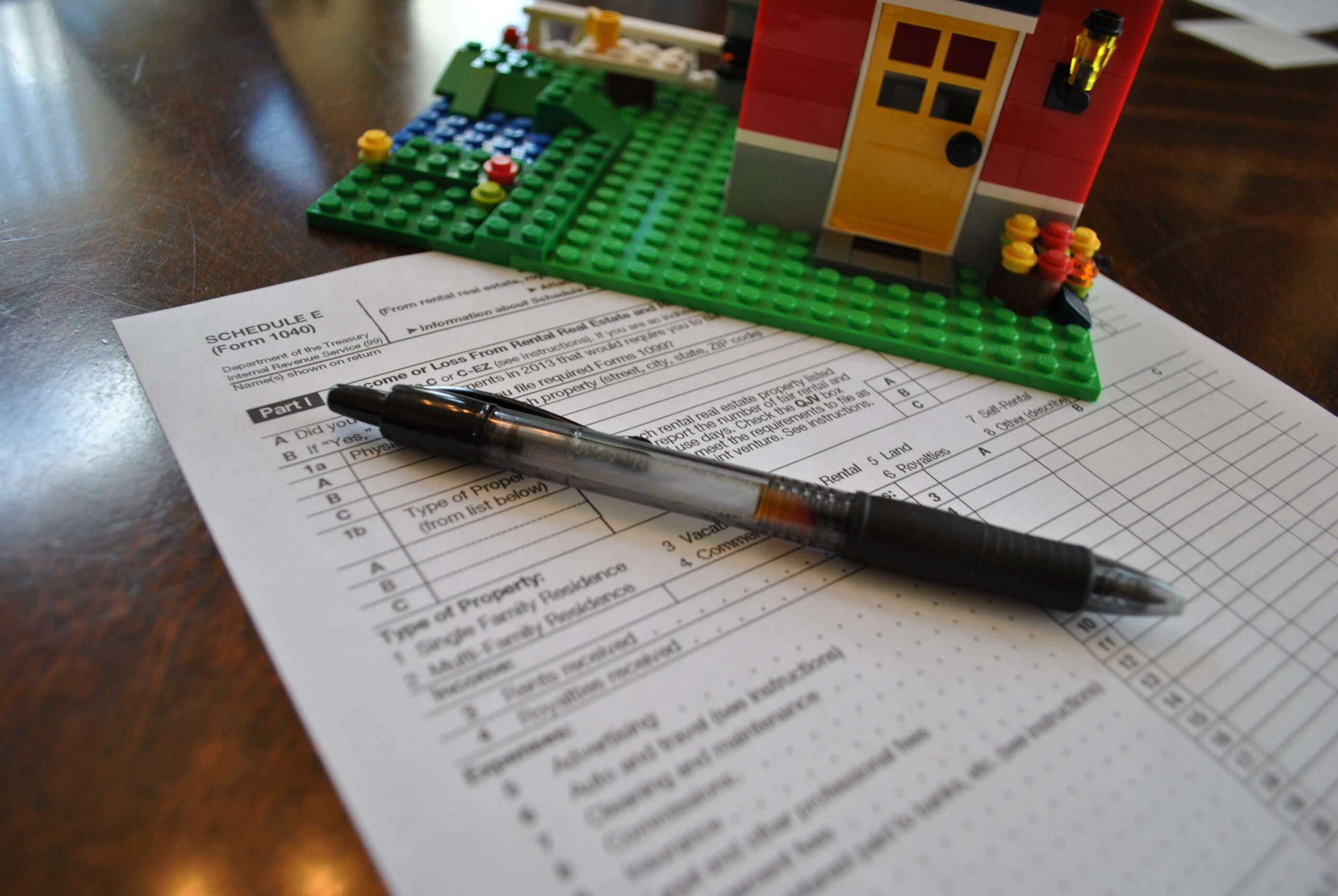

Whether you have a rental property for investment reasons or, like many military families, it’s time to PCS, you need to complete and attach IRS Schedule E to your 1040. This information is based on both my personal experience investing in rental real estate...