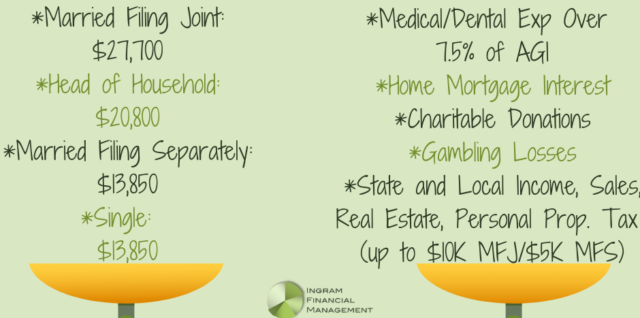

Standard vs Itemized Deductions

Clients often ask me why they can’t deduct their (you name it). Unless you’re paying a high-interest home mortgage or contributing generously to charity, you probably don’t have enough eligible Continue reading Standard vs Itemized Deductions