As you’re well aware by now, tax laws have changed for 2018. With just over 3 months left in the year, now is a good time to see how these changes will affect your bottom line. Contact me to obtain your 2018 individual tax planner.

1 – Standard Deduction Increase

Married filing jointly standard deduction is now $24,000 (up from $12,700 in 2017).

Single taxpayers and married filing separately standard deduction is now $12,000 (up from $6,350 in 2017).

Heads of Household standard deduction is now $18,000 (up from $9,350).

2 – Personal Exemptions

Personal exemptions have been eliminated.

3 – Child Tax Credit

The child tax credit is now $2,000 per qualifying child, under age 17 (up from $1,000 in 2017).

4 – Family Credit

A new $500 credit is now available for dependents who do not qualify for the $2,000 credit…like your college students or parents.

*The max adjusted gross income (AGI) to receive the full credit for both the Child Tax Credit and Family Credit has increased to $400,000 for married filing jointly and $200,000 for all other filing statuses.

5 – Mortgage Interest

The mortgage interest deduction is capped at $750,000 for mortgage loans taken out after 15 December 2017. The limit remains at $1 million for mortgage loans taken out before 15 December 2017.

6 – State and Local Taxes

This itemized deduction is capped at $10,000 for both income and property taxes paid during the year.

7 – Retirement Accounts

Employees with a 401(k), 403(b) and most 457 plans, and the Thrift Savings Plan can now contribute up to $18,500 this year (up from $18,000 in 2017).

8 – 529 Withdrawals

Qualified higher education expenses now include up to $10,000 annually for tuition at an elementary or secondary public, private, or religious school.

9 – 20% Pass-Through Deduction for Business Owners

Income earned via a pass-through business (sole proprietorship, partnership, S corporation, limited liability company (LLC), or limited liability partnership (LLP) who reports income on their individual tax return) may qualify to deduct up to 20% of their net profit or qualified business income (QBI) from each pass-through business they own. This includes rental income.

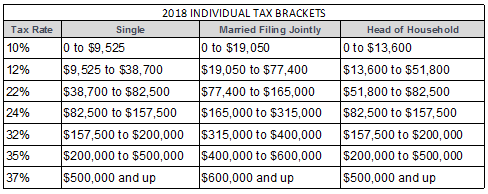

10 – Tax Brackets