by Attiyya | Aug 28, 2020 | Taxes

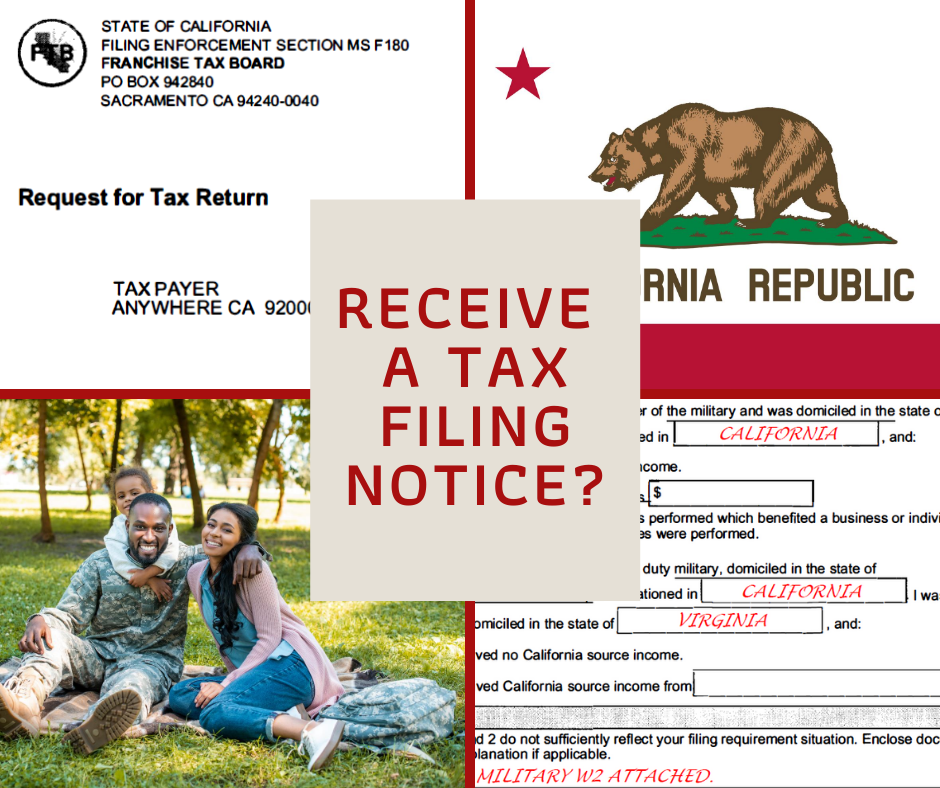

Taxpayers who filed a federal tax return with a California (CA) address listed on their 1040, will likely receive a computer generated letter requesting a CA state tax return be filed. When you receive this letter, do not panic! Most military families stationed in CA...

by Attiyya | Jan 24, 2020 | Taxes

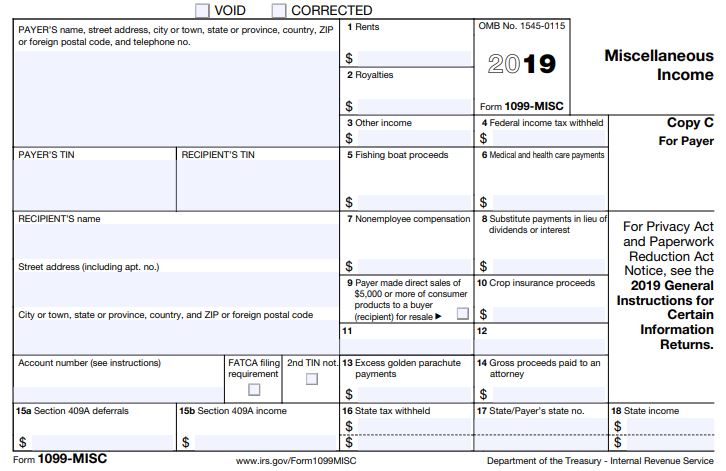

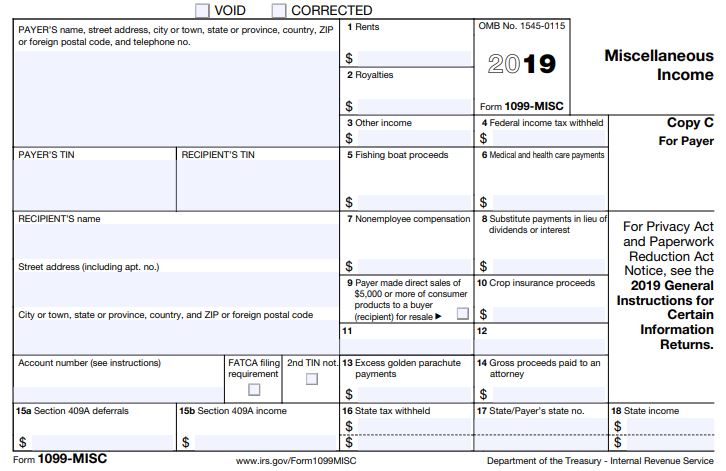

The deadline for 1099-MISC reporting non-employee compensation (NEC) is 31 January 2020. To avoid IRS failure to file penalties, contact me for assistance and to inquire about preparation fees. The use of Form 1099-MISC is common for small business owners...

by Attiyya | Jan 6, 2020 | Taxes

At the end of December 2019, the government approved the following tax extenders for the current tax season. 1. Mortgage insurance premiums deduction – Also known as PMI or the VA Funding Fee. If you paid this premium in 2018 during the purchase of your home,...

by Attiyya | Dec 27, 2019 | Taxes

For the month of December, I’ve be giving away several FREE copies of one of my favorite books. Today’s book is The Alchemist by Paulo Coelho! Visit my Facebook page to get your copy! Merry Christmas!