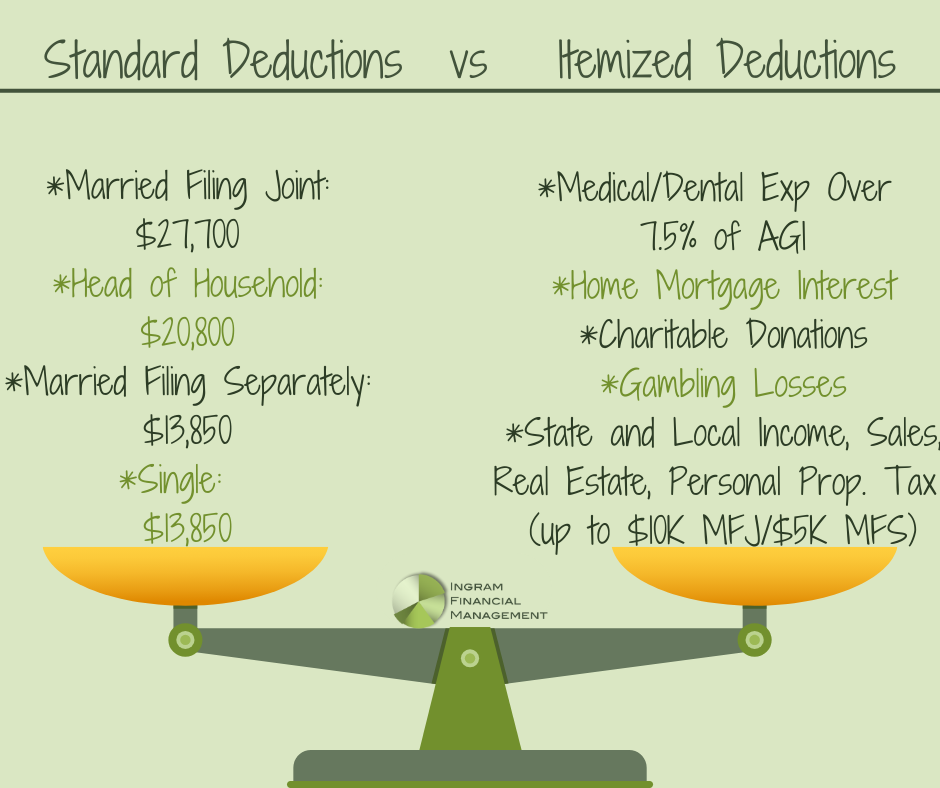

Clients often ask me why they can’t deduct their (you name it). Unless you’re paying a high-interest home mortgage or contributing generously to charity, you probably don’t have enough eligible expenses to deduct on Schedule A. Your Schedule A expenses would only be reported if they exceed the 2023 standard deduction amount for your filing status – $13,850 for single and married filing separate returns, $20,800 for heads of household returns, and $27,700 for married filing joint returns.

One of the most confusing Schedule A deductions is for medical and dental expenses you paid for yourself, your spouse, or your dependent(s). You can only deduct the expenses that exceed 7.5% of your adjusted gross income (AGI). For example, if your AGI is $75,000, only expenses that exceed $5,625 are eligible to be claimed as a deduction.

Visit the IRS website for the complete list of the personal expenses you can and can not deduct.