by Attiyya | Feb 1, 2024 | Taxes

I can’t thank you all enough for your support and referrals! I’m at full capacity and am not able to take new clients for the 2024 tax season. Check out https://militarytaxexperts.org/ to find a tax professional I recommend.

by Attiyya | Dec 21, 2023 | Taxes

Annuitant 1099-RAvailableRetiree & Former Spouse 1099-RAvailableCivilian Certificate for Income Tax Adjustment22 Dec 2023Navy Student Loan Repayment Program (SLRP) W-204 Jan 2024Reserve Air Force, Army, Navy, and Space Force W-2 05 Jan 2024 Army Non-Appropriated...

by Attiyya | Sep 25, 2023 | Taxes

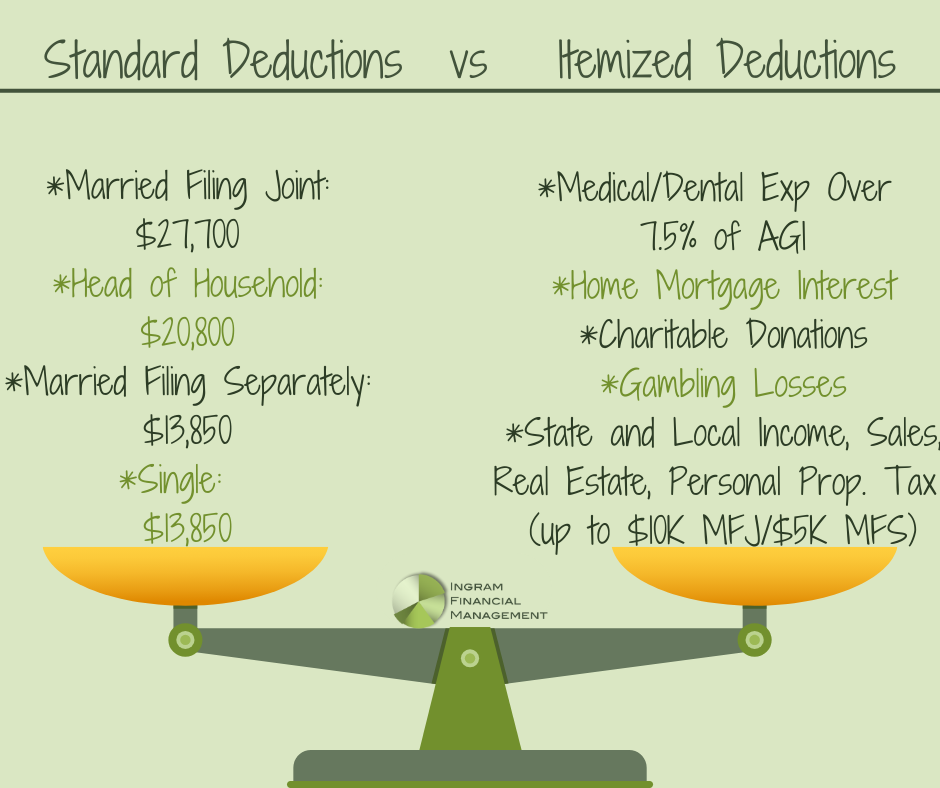

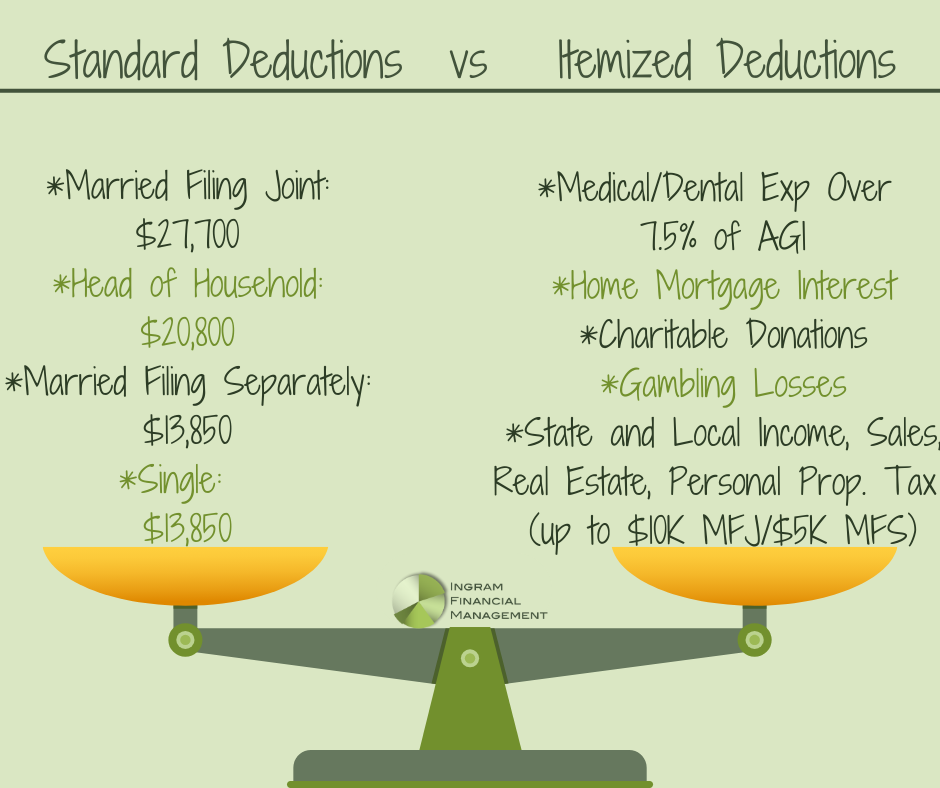

Clients often ask me why they can’t deduct their (you name it). Unless you’re paying a high-interest home mortgage or contributing generously to charity, you probably don’t have enough eligible expenses to deduct on Schedule A. Your...

by Attiyya | Sep 22, 2023 | Financial Counseling, Taxes

We’ve been investing in 529s for our children for almost two decades. Like most of you, we hope to seamlessly combine our 529s with our Coverdell Educational Savings Accounts (ESA), Post 9/11 GI Bill benefits, scholarships, and education tax credits. With more...

by Attiyya | Jan 10, 2023 | Taxes