by Attiyya | Sep 25, 2023 | Taxes

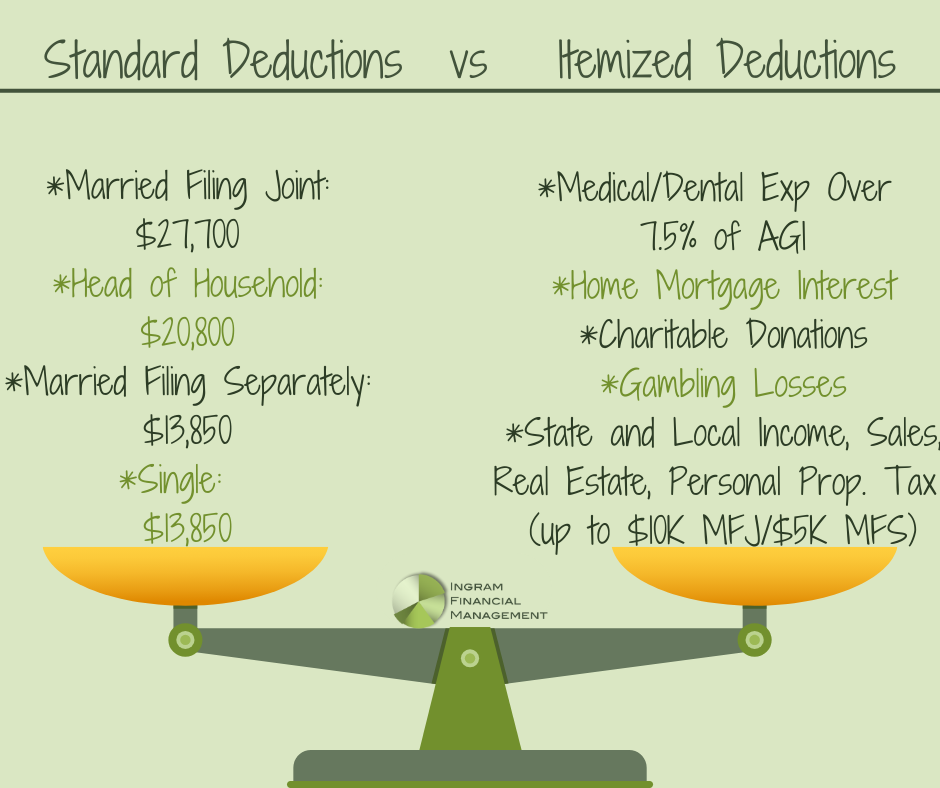

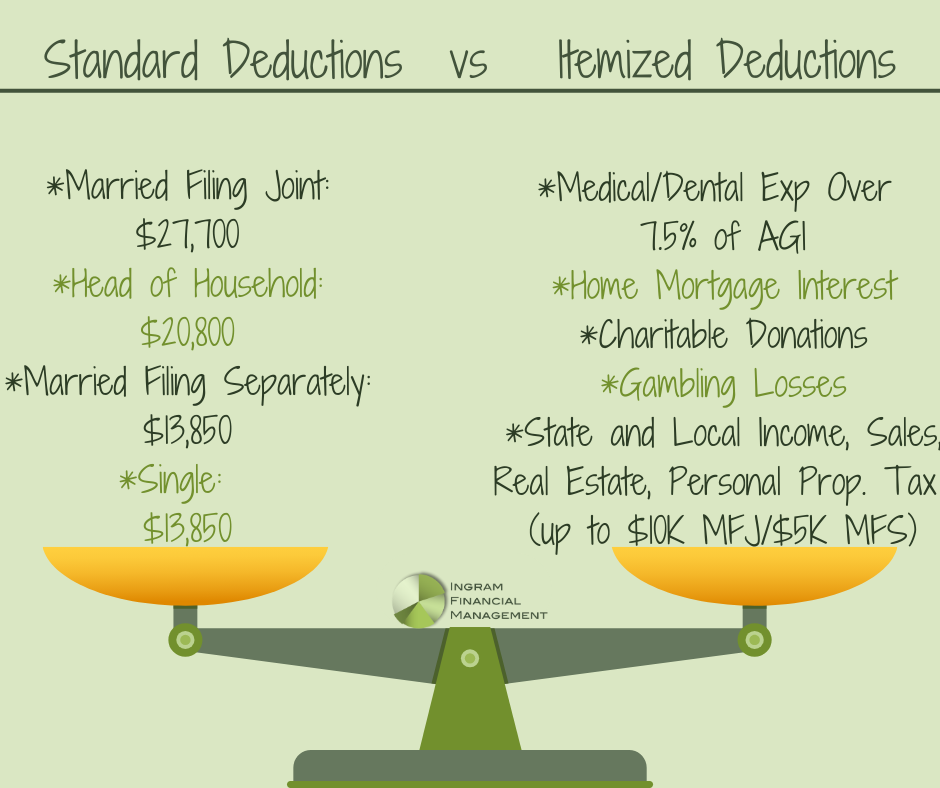

Clients often ask me why they can’t deduct their (you name it). Unless you’re paying a high-interest home mortgage or contributing generously to charity, you probably don’t have enough eligible expenses to deduct on Schedule A. Your...

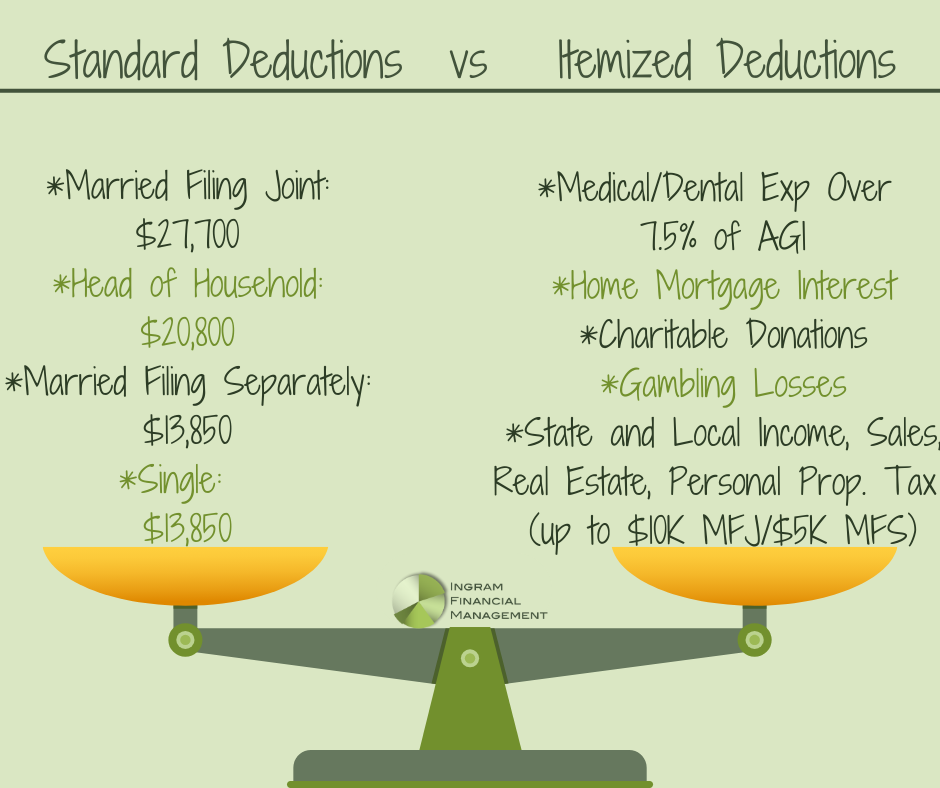

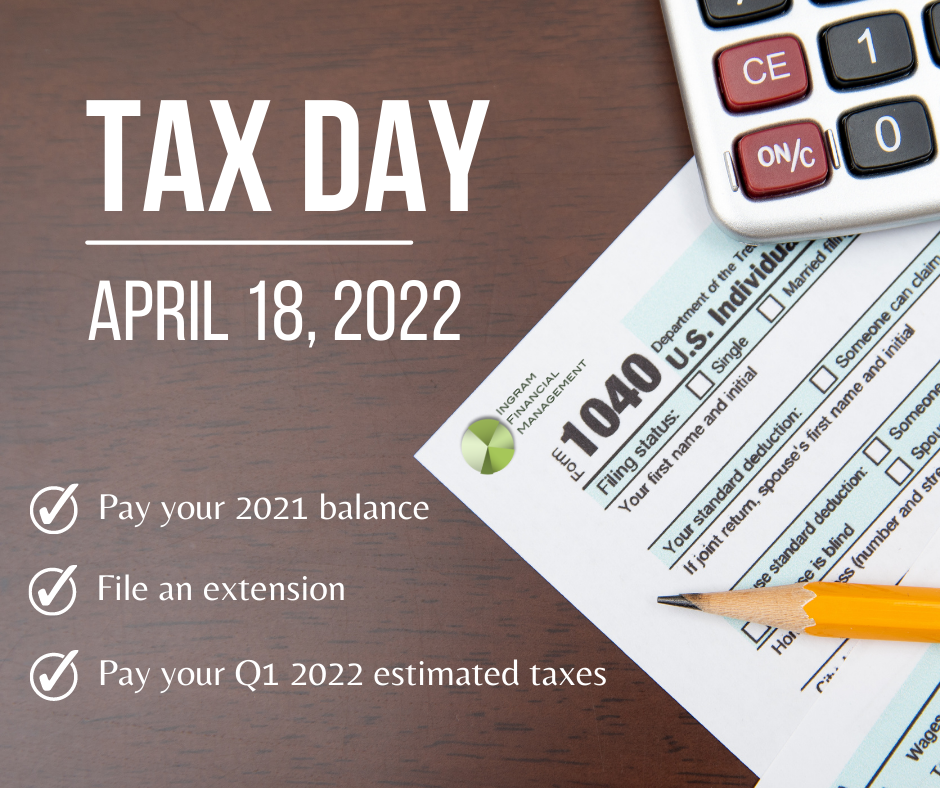

by Attiyya | Apr 18, 2022 | Taxes

by Attiyya | Jun 9, 2014 | Financial Counseling, Taxes

Thanks to low interest rates and several first-time home buyer programs, many families have decided to purchase real estate in the last several years. At some point, most of you will make the decision to sell for reasons like an expanding family, job...

by Attiyya | Apr 27, 2014 | Taxes

The goal for most tax payers is to keep their taxable income (line 43 of the 1040) as low as possible. Your taxable income is used to determine where you fall on the 2013 Tax Brackets chart below and the amount of tax you’ll owe for the year. Luckily, there...

by Attiyya | Apr 27, 2014 | Taxes

Currently, the IRS has no mandatory testing or education requirements for paid tax preparers, which leaves the door wide open for preparer fraud. Some states, like California, have implemented stipulations that must be met to legally prepare taxes for a fee. I...