by Attiyya | Sep 25, 2023 | Taxes

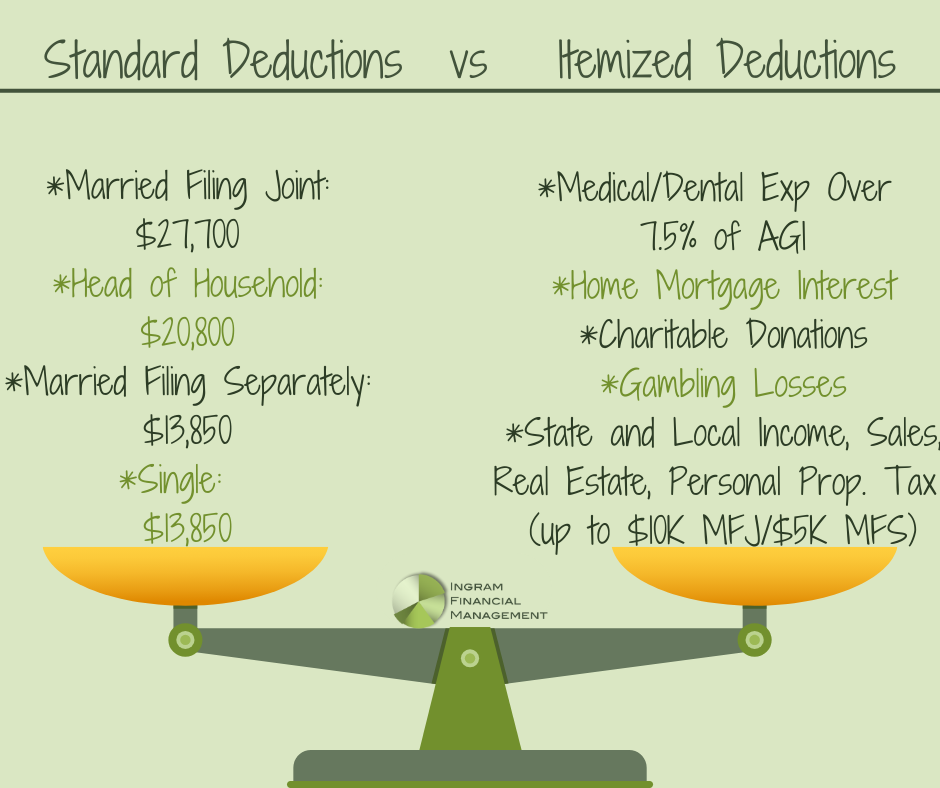

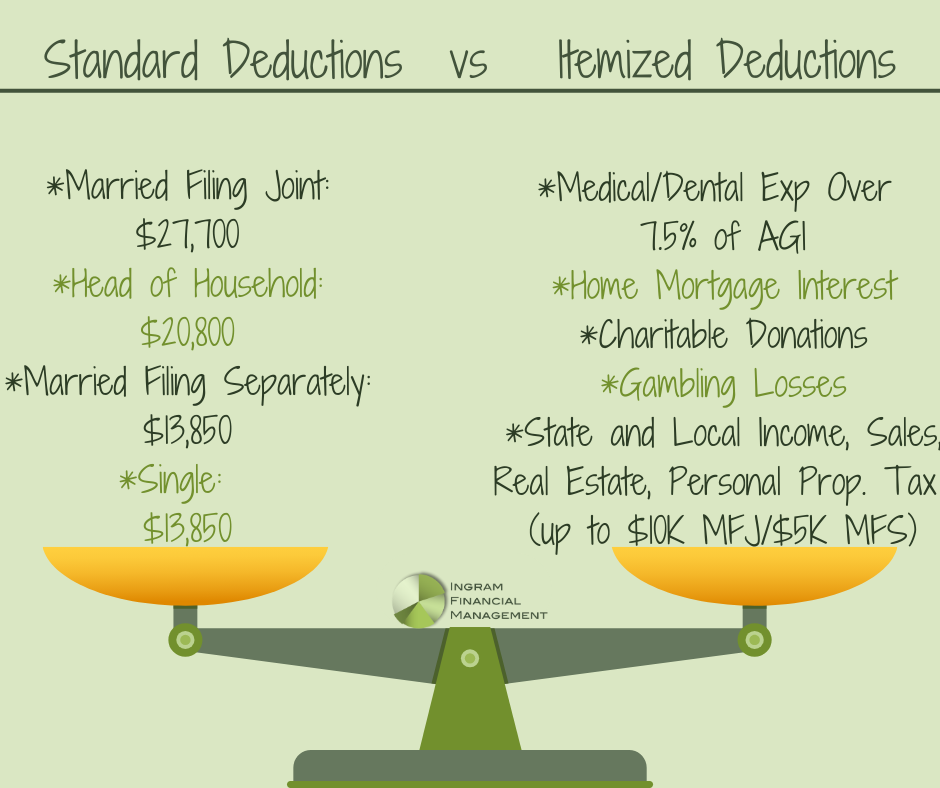

Clients often ask me why they can’t deduct their (you name it). Unless you’re paying a high-interest home mortgage or contributing generously to charity, you probably don’t have enough eligible expenses to deduct on Schedule A. Your...

by Attiyya | Apr 28, 2014 | Financial Counseling, Taxes

Today I hired my first employee, Miss. M. Ingram – Administrative Assistant! Of the three candidates who applied – Miss Ingram and her two younger brothers – her maturity, proven leadership, and ability to spell her new job title learn more about...

by Attiyya | Apr 27, 2014 | Taxes

You only have 1 week left – that’s 7 more days – until your 2013 federal tax return is due! If you’re still waiting for the tax fairy to magically appear and prepare your tax return…give me a call, I may be able to fit you in. 😉 For you...

by Attiyya | Apr 27, 2014 | Taxes

The goal for most tax payers is to keep their taxable income (line 43 of the 1040) as low as possible. Your taxable income is used to determine where you fall on the 2013 Tax Brackets chart below and the amount of tax you’ll owe for the year. Luckily, there...

by Attiyya | Apr 27, 2014 | Taxes

Currently, the IRS has no mandatory testing or education requirements for paid tax preparers, which leaves the door wide open for preparer fraud. Some states, like California, have implemented stipulations that must be met to legally prepare taxes for a fee. I...